Value Creation

We believe in a simple and targeted approach to asset management. Our goal is capital preservation and a productive income stream.

Capital preservation is our main focus. We maintain strong relationships with our tenants and maintain our properties safe and attractive for existing and prospective tenants. In addition, our vendors are well equipped to help us respond quickly to service requests, so tenants can expect prompt and responsive service. Staff is available 24 hours a day, 7 days a week.

Big Box Acquistion

Value Creation Case Studies

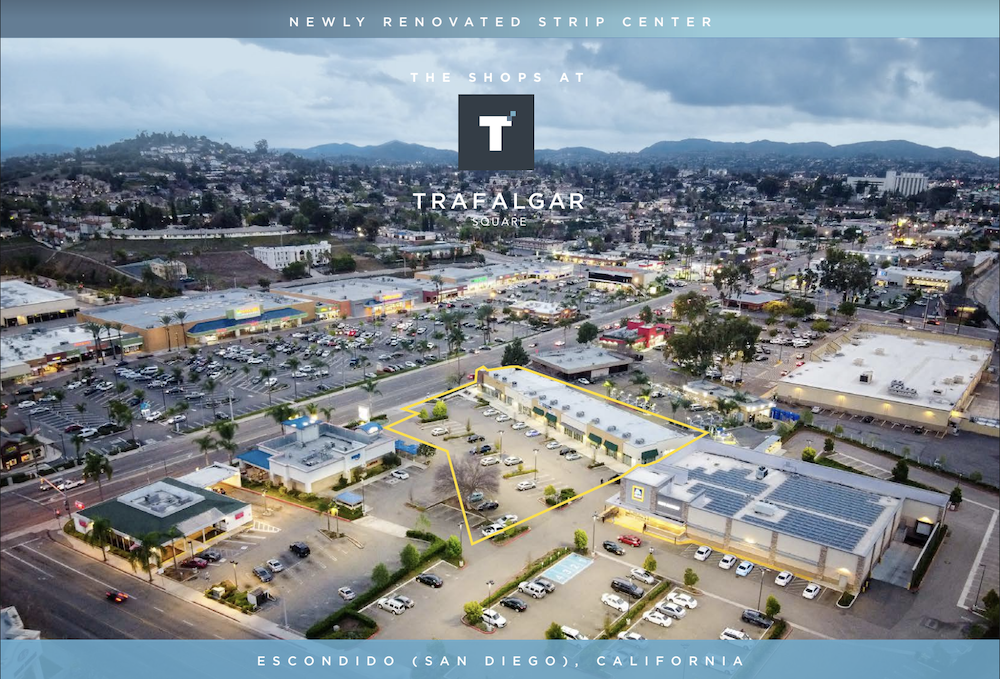

Escondido, California | Trafalgar Square

Shops at Trafalgar Square, a 100% occupied, 14,164 SF strip center located in the densely populated City of Escondido (San Diego County), California. The Property is within an ALDI (NAP) anchored center, featuring an IHOP (NAP) pad, and is comprised of a mix of essential local/regional, internet-resistant tenants, providing an investor security in the real estate, tenant lineup, and long-term cash flow. All of the Tenants within the Property have recently signed new 5 to 10 leases, which feature rare 3% annual rent increases.

The subject property’s location is strategically positioned on the East Valley Parkway corridor at the signalized intersection of East Valley Parkway and Harding which features over ±32,500 VPD traffic volume at intersection. The trade area demographics feature a 1-Mile population base of nearly 42,000 residents and over 140,000 residents within a 3 mile radius. East Valley Parkway is the main “East / West” Arterial providing access to and from the I-5 Freeway and Highway 78.

Value Creation Case Studies

Fresno, California | Ashlan Park Shopping Center

Ashlan Park Shopping Center (“Ashlan Park” or the “Property”), a 153,870 square foot grocery-anchored neighborhood center located in Fresno, California. Anchored by Save Mart Supermarkets, the Property is 91% leased, holding an irreplaceable position within the dense residential neighborhood of Ashlan Park and has recently undergone approximately $6MM worth of capital improvements. The Property boasts an exceptional tenant roster comprised of a diverse mix of everyday needs and services, e-commerce resistant, and experience-focused tenants including Save Mart, dd’s Discounts, Starbucks, Dollar Tree, Arby’s, Chevron, and Fit Republic Health Clubs.

Tenants average an astounding 15.7 years of occupancy, demonstrating long-term commitment and creating an exceptionally stable cash flow. With recent brand new leases and renewals, investors are protected from near-term rollover with a weighted average remaining lease term of 7.4 years. With over 150,000 residents within a 3-mile radius, Ashlan Park is well-positioned in a high barriers-to-entry market and offers investors an opportunity to acquire an infill, generational asset at a fraction of replacement cost.

Big Box Acquistion Case Studies

Ventura, California | Pacific View Mall

Immediate repositioning opportunity of 164,433 SF former Sears Box with a 14, 130 SF former Sears Auto Center pad located at the Pacific View Mall.

The Property is strategically located on E Main Street (30,566 VPD) approximately 0.5 miles from the SR-126/ US 101 interchange. Accessibility is further enhanced with multiple traffic signals that provide left hand turn access to the Property.

The Property was acquired in 2022. Since acquisition approximately ½ of the GLA has been leased to national and regional retailers.

Before and After

Before

After

Big Box Acquistion Case Studies

Temecula, California | Butterfield Station

95% occupied, 70,418 SF neighborhood shopping center located on a major retail traffic corridor in The City of Temecula (Riverside County), California.

Featuring Best Buy, Fitness 19, and Wells Fargo, and is comprised of a mix of essential local/regional, internet-resistant tenants, providing an investor security in the real estate, tenant lineup, and long-term cash flow.

The Property was acquired in 2022. The business plan is to re-merchandise the tenant-mix and to execute a multi-parcel break-up strategy leveraging the demand for this asset class.

Before and After

Before